Stop looking at the bank account trying to understand what...

IT HAS TO BE SOMEWHERE

Stop looking at the bank account trying to understand what happened to it. Your money is gone.

Greedy lenders have it. Or perhaps it may even be your land lord or you just lost it somewhere…

I don’t know. The matter of the fact is the you need to find more and you really have to look for them because those elusive dollars don’t grow on trees.

Wait… they do… Dollar bills are in fact a mixture of wood cellulose, cotton and linen.

This gave me an idea…But That’s another story. Back to your loss.

You most likely don’t have them laying around. You job doesn’t pay enough or maybe it does but you have so many things to buy and pay for… Your family needs to be fed and bills keep on stacking up.

I get it.

UNDERSTANDING THEPROBLEM

Budgeting it’s not something we have been taught in schools. They don’t teach us how to properly handle our salaries and those ads on TV and internet don’t help either. They only thing we can do is to do the best we can. And that will be true except for a couple of things you will read in this article.

You see… when you don’t have enough money, something isn’t working. Something is wrong… you may be overpaying somewhere or you didn’t calculate correctly. Sometimes can be hidden fees, unexpected hikes in your electricity that along with inflation and other month to month needs, can really hurt your saving potential, ruining your financial goals.

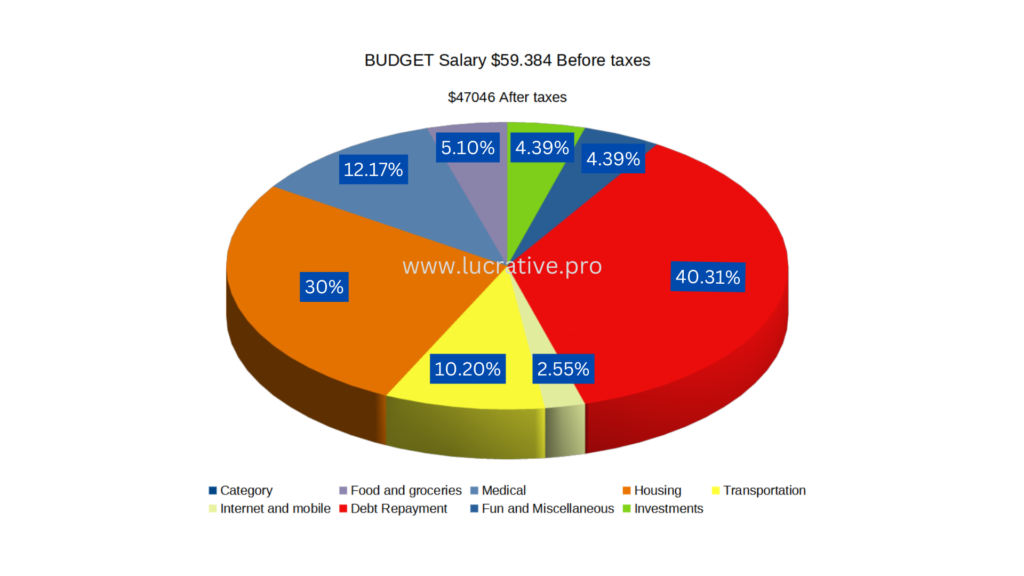

Lets have a look on a budget chart of an average American like you or me:

Information gathered by the bareu of labor and statistics of united states of america.

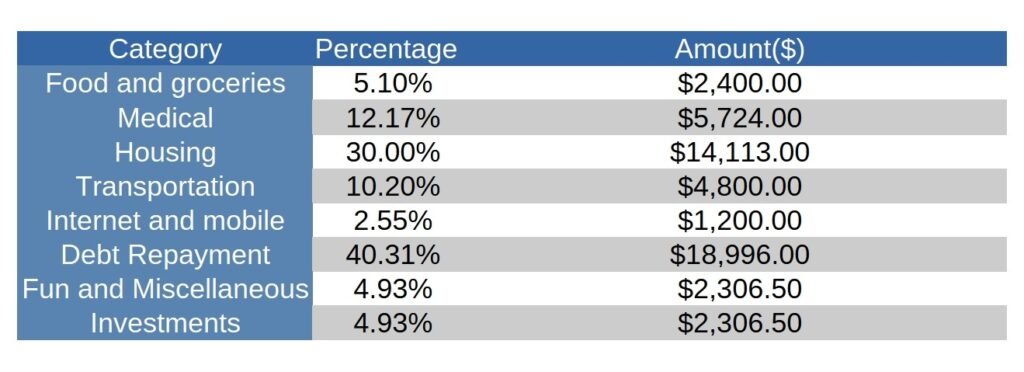

In here you can see a break down of an average American budget for an individual tax payer.

The Current median salary in United States of America nation wide is $59.384 Dollars that after taxes becomes $47.046. Yours (if you even have one) may differ as there’s many different salaries, states, cities, bonuses and many different variables. You may be a single mother, or a father; you may have somebody that you are taking care of or just different needs or priorities. This is just an average.

THE MEAT AND POTATOES

When it comes to budgeting it’s important to understand that it is meant to keep track of your income and expenses leaving less room to possible financial mistakes that can make you miss certain elusive couple of hundreds(Wink wink). If you create one on your own, and you always use it, can help you understand where your miss-adjustments are and free up some cash for you. There are always areas to improve in one’s finances and every experts recommends them.

There are areas of improvement in every budget. It may take bit of sacrifice or changing a couple of things but if you stick to your budget, improve it and see where those adjustments can be made, the rest is is just discipline. Focus on your priorities and your financial goals and picture yourself at the end of the road with the extra cash. You may be able to increase your investment budget or a little bit extra for your savings account or 401k retirement plan.

HOW TO CREATE A BUDGET

Here is where most people fail. You have to have the willingness to create one. Most people fail because it may mean SACRIFICE. You see… where there’s sacrifice there’s also a reward. If you want to retire earlier (or retire at all) or to take yourself to the next tax bracket, it is essential to assign a figure to each of your budget categories and never go over them.

Start from the basics: You know that there are certain categories that require a fix amount of dollars every month that, even if you want to modify them, you can’t. Your mortgage payments or your rent, your medical insurance if you have one. Your internet bill and your bare minimum basic need such: protein intake, carbohydrates in the form of pizza and pasta to name a few. There are things that never should be changed. In the case of your mortgage and your rent you know that it should never

go over 30% of your salary. Your debt repayment should never go down(if you can you should always increase your repayment rate), give priority to the smallest debt you have and keep building confidence and momentum to keep on paying the largest ones.

Run your numbers: As you continue to assign percentages to fix payments, calculate what those percentages represent of your take-home salary. For example:

$5.724.00 is what percentage of $47,046

5,724.00 divided by 47,046 and multiply the result by 100.

5724/47,046= 0.12166* 100 = 12.7 (Witch it is the rounding of the decimal numbers)

Keep doing this for every category that you know for certain what is the fix amount it’s going to the be the payment of. That will be eliminating percentages of the total money you have to spend of your salary. There might be things you don’t know what figure to assign just yet but keep on calculating.

Non-fix expenditure: The wants, nights out, vacations, super expensive phones or a frapuccino can be non fix expenditures. Hikes on your electric bill, a car maintenance may also represent non-fix expenditures but one has to estimate, based on: neighbors answers, internet, previous years receipts or information you have about these expenditures. Budget a little bit over of what you expect for these things since these may sometimes caught you off guard.

The shoulds and should not: You sometimes can go over certain categories (but not recommended)

and you can definitely go and spend more on fun. But it may imply not paying your rent in time or not being able to pay for your internet service. The point Is that budgets are there for those things not to happen. And you will able to do so by choosing carefully your shoulds and should not.

Repeat with me: I should never go over my budget on dinning out. But you can say: I should over budget for my investments and education.

IMPROVING YOUR PERCENTAGES

Consider reducing some categories like your budget on extra food that you throw away. Be efficient with your consumption. At the of the year may represent a chunk of your salary.

If you can use public transport. Americans are held back by new car payments or expensive insurance and gasoline. Park further away from your job to save some mileage. Use last mile services or consider buying yourself an electric scooter or bike. Apart of being healthier, some job positions offer some extra dollars a month for biking to work.

Take care of your health and you may not need the premiums of your medical insurance. It’s a couple of elusive hundred dollars you may need for a different financial endeavor.

Invest more. Whether you take advantage of your employer matching 401k retirement plan contributions or not, if you invest diligently you can, not only, improve your percentages but you may get to your financial goals faster.

BOTTOM LINE

To have a budget and to respect it, has an uncountable value. From Business to your grandmother, they all use one. Is never late to start and you will benefit from having one. You will build discipline to confront financial challenges and with them, you will ensure that your money requirements will always be covered.

NASDAQ : RESILIENCE AND GROWTH

NASDAQ, Inc, a leading global securities exchange operator headquartered in...

THE NEXT THING FOR YOUR PERSONAL FINANCE

Home Contact us Article Catalog Home Contact us Article Catalog...

WHERE’S MY 500$? A budgeting problem.

Home Contact us Article Catalog Home Contact us Article Catalog...

Investing basics: How to be 10% richer

Home Contact us Article Catalog Home Contact us Article Catalog...

NEW BLOG POST TEMPLATE

Stop looking at the bank account trying to understand what...

NASDAQ : RESILIENCE AND GROWTH

NASDAQ, Inc, a leading global securities exchange operator headquartered in...

THE NEXT THING FOR YOUR PERSONAL FINANCE

Home Contact us Article Catalog Home Contact us Article Catalog...

WHERE’S MY 500$? A budgeting problem.

Home Contact us Article Catalog Home Contact us Article Catalog...

Investing basics: How to be 10% richer

Home Contact us Article Catalog Home Contact us Article Catalog...

Article blog template template

Investing Financial Planning Crypto Real Estate Alternative Investments Banking Fintech...

The mock article

The stock market is a platform where publicly traded companies...

LOREM IPSUM

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean ullamcorper...