Stop looking at the bank account trying to understand what...

INVESTING

NASDAQ : RESILIENCE AND GROWTH

- May 30, 2024

- 4:07 pm

- Lucrative.pro

- Featured Articles, Investing

NASDAQ, Inc, a leading global securities exchange operator headquartered in the United States, has been provoking waves with its robust performance. The heavily influenced Index by Apple, Microsoft, Alphabet, Amazon, Facebook and NVIDIA conforming more than 40% of the index, has experienced interesting movements in these recent years. This article provides a thorough analysis into NASDAQ‘s stock market journey and growth trends over recent years.

STOCK PERFORMANCE

NASDAQ‘s current trading price stands impressively at $60.12, marking a significant increase of 27.24% from its lowest point in the past year and only slightly below its highest value within that same period by about 5.41%. This upward trend indicates NASDAQ‘s resilience amidst market fluctuations over time. However, it is essential to note some short-term volatility as well; the stock experienced a decline of -3.39% in one month but managed positive returns across longer periods. A 6-month total return was recorded at an impressive 21.89%, while yearly gains stood strong with both six months and twelve months showing increases by 6.05% and 12.89%, respectively, demonstrating NASDAQ‘s ability to bounce back from temporary setbacks effectively.

REVENUE GROWTH

NASDAQ has seen some fluctuations in its revenue growth over the past year; however, it remains a key indicator of overall performance and potential for future successes. The most recent quarterly data shows an encouraging increase of 9.2% from Q4 to March 31st, 2024.

Despite this positive trend in revenue growth over the last year, there was a slight dip as annual revenues decreased by -2.6%, reflecting some challenges faced during that period and emphasizing NASDAQ‘s need to address these issues for sustained success moving forward.

EARNINGS GROWTH

NASDAQ has also encountered difficulties in its earnings growth, with a decrease of 5.88% from continuing operations over the fiscal year ending December 31st, 2023. The most recent quarterly data for Q4 to March 31st, 2024, showed an even more significant decline in earnings by -22.59%, indicating a need for strategic adjustments and improvements within the company’s operations.

TRENDS AND STRATEGIES

Despite these challenges faced with revenue growth and earning, NASDAQ has been able to maintain its position in an ever-changing market landscape due to several factors:

- The U.S economy’s resilience is supporting consumer spending and labor force strength — a vital aspect for the overall health of financial markets as it drives economic growth through increased demand, investment opportunities, and job creation.

- An increase in IPO activity has been observed with 39 operating company listings during Q1 of 2024; this signals potential recovery from previous downturns while also indicating a growing confidence among companies to go public amidst favorable market conditions.

- NASDAQ’s Index business and Financial Technology division have shown strong revenue growth, with the latter benefiting significantly due to new client signings in recent quarters — highlighting their ability to adapt quickly while capitalizing on emerging opportunities within this rapidly evolving industry.

- The company has also seen success from its Financial Management Technology business as it continues to grow and expand through strategic partnerships, acquisitions, or new product launches that cater to the changing needs of clients in today’s marketplace.

However, NASDAQ faced a revenue decline within their Market Services division due primarily to lower volatility levels across U.S options markets and increased competition — an issue they must address moving forward while also exploring new opportunities for growth or diversification that can offset this challenge effectively.

INVESTOR SENTIMENT

When it comes to investors’ sentiment, the focus tends to be on specific stocks like Amazon (NASDAQ: AMZN), which trades under NASDAQ‘s umbrella — a reflection of its prominence in today’s market. However, investors tend to talk about NASDAQ as different thing, instead, investors tend to analyze individual stock performance and potential growth opportunities while considering the broader implications for their portfolios or strategic decisions moving forward.

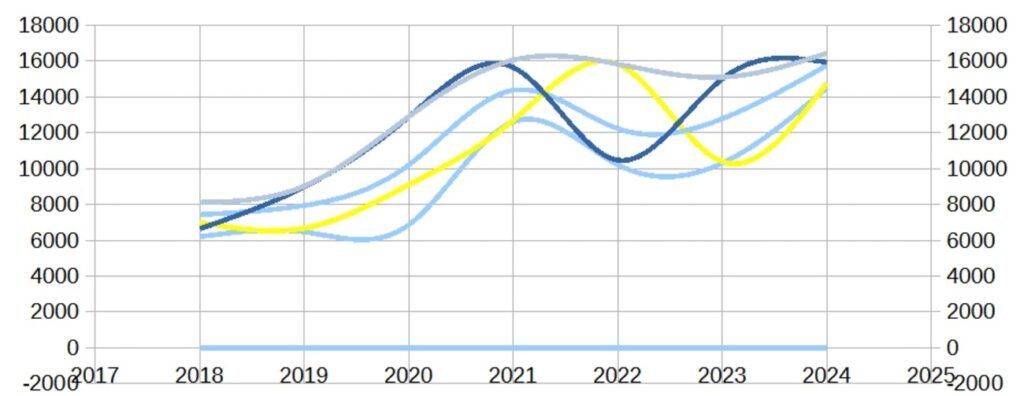

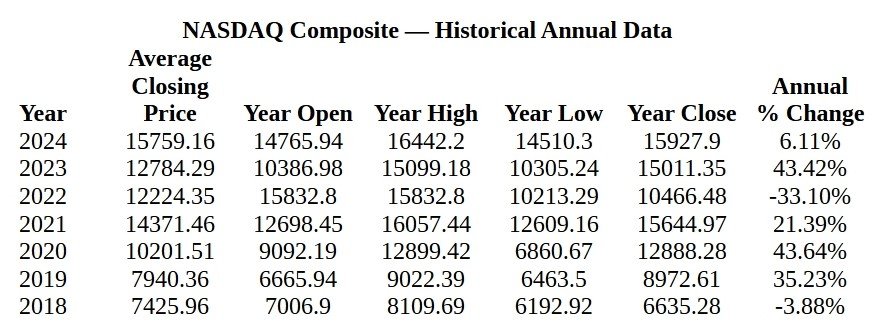

For the last seven years, the overall sentiment towards the NASDAQ has been characterized by points confidence and prudent skepticism. The NASDAQ composite has been approaching its prior record high of 16,057 that occurred on November 19 of 2021, that indicates an aggressive upwards direction, only made possible by it’s tech sector dominance contributing massively to the surpassing mark of 5,000 to the S&P 500 index.

Here is a chart of the performance of the NSDQ this last 7 years:

NDSQ hasn’t escaped to the effects of volatility. For the last two years investors have been continuously pivoting from positivity to prudence in a inherently tumultuous market. The fear of a bubble in the S&P 500 index and it’s overvaluation due to the effects of these tech giants, had made investors be more conservative at the time of choosing their preferred stocks. In spite of a high inflation scenario, the NASDAQ it’s expected to reach triple digit growth in the next four years.

The NASDAQ‘s journey has been a mix of ups and downs over recent years — from strong revenue and earnings gains to facing challenges in certain areas like declining revenues and decreasing earnings growth rates. However, the company continues to adapt quickly while capitalizing on emerging opportunities within its diverse business segments such as their Financial Technology divisions that have shown significant potential for future success.

As investors continue their analysis of NASDAQ‘s performance in light of recent trends and strategic directions taken by the company, it is essential to remember this dynamic financial landscape requires constant attention while also embracing opportunities as they arise — ultimately leading towards a more prosperous future for all stakeholders involved.

However, the NASDAQ‘s resilience amidst market fluctuations and its ability to adapt quickly in response to changing conditions make it an attractive investment opportunity worth considering within the broader context of today’s financial markets — a testament to both its past successes as well as future potential.

Sources:

– Nasdaq Reports First Quarter 2024 Results; Strong Execution Delivers Double-Digit Solutions

Revenue Growth

Apr 25, 2024,

– AAII Investor Sentiment Survey

– CNN Fear and Greed Index

NASDAQ : RESILIENCE AND GROWTH

NASDAQ, Inc, a leading global securities exchange operator headquartered in...

THE NEXT THING FOR YOUR PERSONAL FINANCE

Home Contact us Article Catalog Home Contact us Article Catalog...

WHERE’S MY 500$? A budgeting problem.

Home Contact us Article Catalog Home Contact us Article Catalog...

Investing basics: How to be 10% richer

Home Contact us Article Catalog Home Contact us Article Catalog...

NEW BLOG POST TEMPLATE

Stop looking at the bank account trying to understand what...

NASDAQ : RESILIENCE AND GROWTH

NASDAQ, Inc, a leading global securities exchange operator headquartered in...

THE NEXT THING FOR YOUR PERSONAL FINANCE

Home Contact us Article Catalog Home Contact us Article Catalog...

WHERE’S MY 500$? A budgeting problem.

Home Contact us Article Catalog Home Contact us Article Catalog...

Investing basics: How to be 10% richer

Home Contact us Article Catalog Home Contact us Article Catalog...

Article blog template template

Investing Financial Planning Crypto Real Estate Alternative Investments Banking Fintech...

The mock article

The stock market is a platform where publicly traded companies...

LOREM IPSUM

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean ullamcorper...